LLC: At the end of that first 60-day window, you’ll receive a notice that your annual report must be filed (and all fees paid) within another 60-day window, or your business will be administratively dissolved.

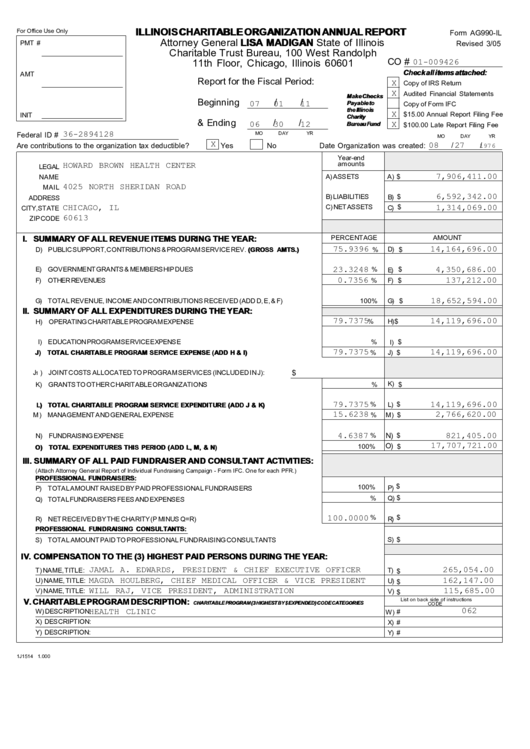

Your franchise tax total = b+d divided by a+c. The allocation factor is based on four criteria:Ī.) value of all property owned by the corporationī.) value of property located in IllinoisĬ.) gross amount of business transacted over the last 12 months everywhereĭ.) gross amount of business transacted over the last 12 months in Illinois You can calculate your Illinois franchise tax using either one of two methods: the allocation factor or paid-in capital. Corporations will still need to file their annual reports, but the accompanying franchise tax filing will no longer be required. As of 2024, this Illinois franchise tax will end. NOTE: The state’s franchise tax is slowly being phased out. Your franchise tax calculation and payment (if applicable) should be included in your annual report filing.

The Illinois Franchise Tax is an annual tax for corporations that conduct business in Illinois. When your annual report is ready to submit, you can send it to: Limited Partnerships (domestic and foreign) If filing by mail, here are the forms you’ll need to use: Entity Type On the following page, you’ll see a link to the online annual report. To file your annual report online, go to the state’s Business Services page and select your entity type.

#Illinois annual report file online how to#

(See the steps for How to Calculate Illinois Franchise Tax below for details.) Only corporations-both foreign and domestic-are subject to Illinois’s franchise tax. When we’re your Illinois registered agent, we’ll send you notification that your annual report is available for filing, and give you the option to file it yourself or have us file it for you. For example, if you originally formed an Illinois LLC on May 16th, the last day to file your report would be April 30th each year.Īlso, an annual report notice will be sent to your registered agent each year. Your report is due before the first day of your company’s anniversary month. Domestic and foreign Limited Partnerships: $100Ĭorporations also must pay any franchise tax owed.

Domestic and foreign LLCs and corporations: $75.

The filing fee varies depending on the business type: How much does the Illinois Annual Report cost to file? You can find your entity’s business file number by visiting the Illinois Department of Business Service’s Corporation/LLC database. NOTE: If you’re filing an annual report for a corporation, you’ll also be asked to include corporate stock information and your franchise tax calculation. Signature, title and name of person filing report.Names and addresses of officers/directors (corporations) or members/managers (LLCs).

#Illinois annual report file online registration#

0 kommentar(er)

0 kommentar(er)